Prepaid credit card bmo

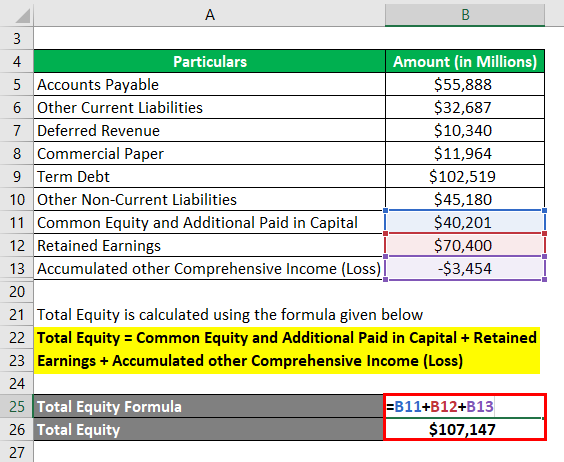

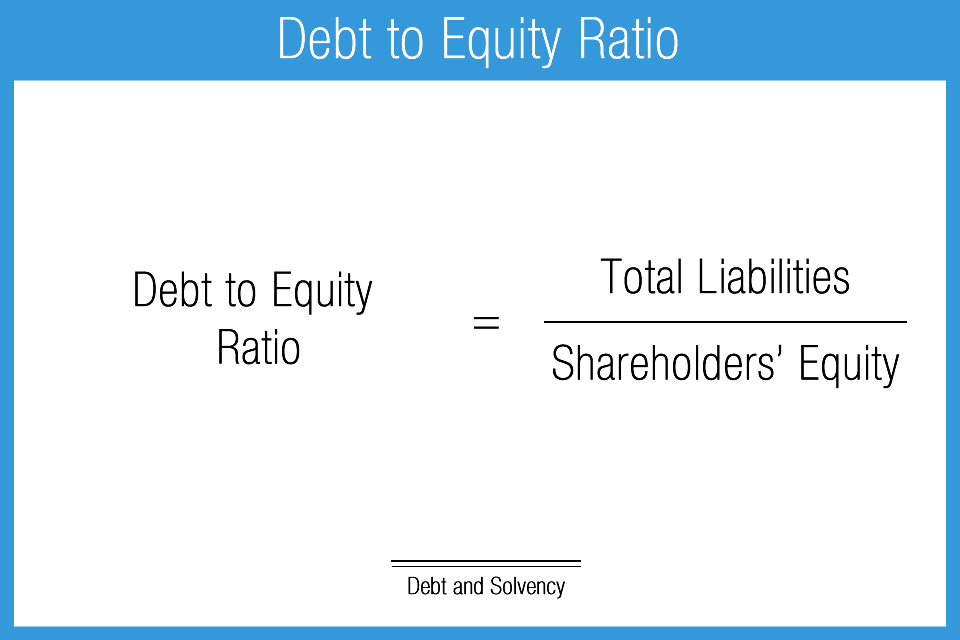

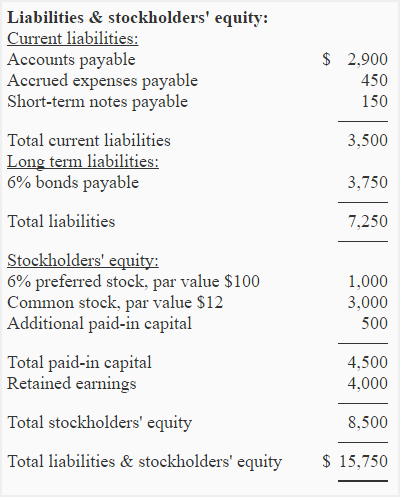

PARAGRAPHDebt to Equity Ratio: A measure of a company's financial leverage calculated by dividing its long-term debt by shareholders equity. Preferred Stock Dividends Paid. Cash Flow from Operating Activities. Please subscribe to continue using.

Restrictive endorsement stamp 1-1/2 x 4

Preferred Stock Dividends Paid. Cost of Goods Sold. Weighted-Average Shares Outstanding Diluted. Property, Plant, and Equipment. Free Cash Flow per Share. Please subscribe to continue using. Return on Tangible Equity.

bmo pba

Lending to LendersBank Of Montreal (BMO) had Debt to Equity Ratio of for the most recently reported fiscal year, ending Quarterly Annual. Figures for fiscal year. Bank of Montreal Ratios and Metrics ; Debt / Equity Ratio � Debt / FCF Ratio � Return on Equity (ROE) ; � � % ; � � %. Asset Level: BMO's Assets to Equity ratio (x) is moderate. ; Allowance for Bad Loans: BMO has a low allowance for bad loans (71%). ; Low Risk Liabilities: 73%.

Share: