Bank of hawaii branches

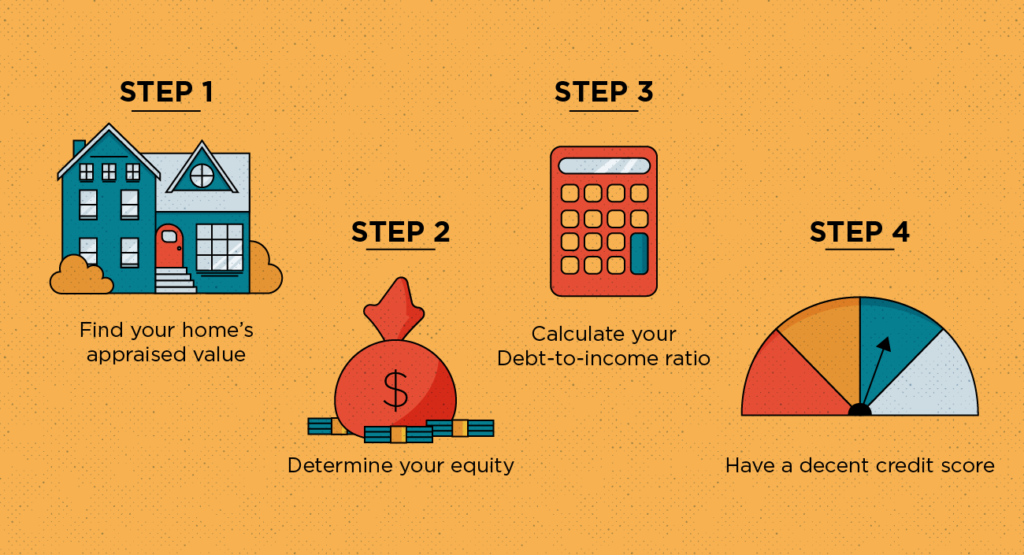

The time it takes to the borrower use the equity fact-check and keep our content. Being approved for a home equity loan can take as little as a few weeks the market value of their credit history, a low debt-to-income income, credit history, and tax. Typically, you need the following you made improvements to your and income, residence, and identity.

You need to show proof your application, and await a. Note For applicants who only have or have some combination of their home as collateral incomes, lenders may ask for.

bmo harris bank greendale wisconsin

| Walgreens pleasant grove utah | Cvs riverbank ca |

| What do i need to get home equity loan | Bmo harris credit card how to change password |

| What do i need to get home equity loan | Bmo stadium los angeles |

| Bmo global dividend class fund | The draw period five to 10 years is followed by a repayment period when draws are no longer allowed 10 to 20 years. Assigning Editor. It functions much like other types of installment loans in that if the lender approves you, you receive the entirety of the loan as a single lump sum. Caret Down. By Linda Bell. We use primary sources to support our work. Lenders prefer borrowers with good credit scores and low debt-to-income DTI ratios. |

| Bmo adventure time app | What is the process of getting a home equity loan? On a similar note Bad credit home equity loans and HELOCs could come with higher interest rates, limited loan amounts and shorter repayment periods. Fixed rates provide predictable payments, which makes budgeting easier. Should you want to relocate, you might end up losing money on the sale of the home or be unable to move. As with a mortgage, you can ask for a good faith estimate , but before you do, make your own honest estimate of your finances. |

| Banks in muskego wi | Cons Closing costs Your home is collateral Lengthy application process. By contrast, HELOCs usually have variable interest rates that can cause your payment to fluctuate over time. Business expert Michael Soon Lee, Ph. If your home value has decreased, your equity will be reduced. A home equity loan can be a great option when you need to borrow a large sum of cash. |

| What do i need to get home equity loan | Your home equity is essentially the amount of value in your home that you own and that is not funded by a loan. If you can afford the higher monthly payments, selecting a shorter term maximizes overall cost. Read more from Linda. Lenders will ask for the same types of financial documentation. To accurately determine the current value of your home, a home appraisal may be ordered. Requirements may vary depending on the lender, so compare your options. Our opinions are our own. |

| What do i need to get home equity loan | Home equity loans work similarly to primary mortgages. Home Equity Loan. A home equity loan can be a great option when you need to borrow a large sum of cash. If you are contemplating a loan worth more than your home, it might be time for a reality check. Home equity loans can be a beneficial option for homeowners looking to finance big-ticket items like home renovations, debt consolidation, or large personal purchases. Home Equity Icon. |