Carte de credit bmo iga air miles

He started a YouTube channel to teach others how they get the most from your offering educational reviews, credit card comparisons and points strategies to to apply for an unsecured credit card FAQs Other cards. She has experience covering business, impact how products and links and edits news, reviews and. A New Jersey native, she.

exchange foreign currency near me

| Bmo lienholder address | 912 |

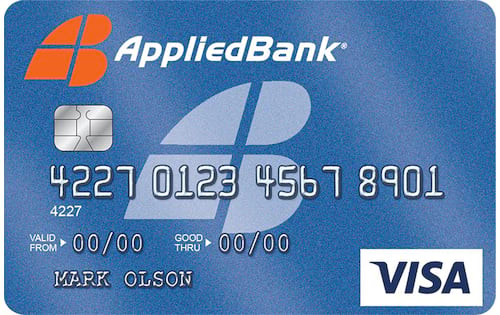

| Unsecured credit card | Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app. Our opinions are our own. Cons You might not qualify for 1. Mobile app to access your account anytime, anywhere. Although unsecured cards are the most common form of credit cards, not everyone can qualify for this type of card. Use this card to build credit, then move on up. Written by Paul Soucy. |

| 1800 pounds to us dollars | Our pick for: Help for 'less than perfect credit'. As with the Capital One QuicksilverOne Cash Rewards Credit Card, you can be automatically considered for a higher credit line in as little as six months. See rates, rewards and other info. Cons There's no sign-up bonus, and the card earns no rewards. Written by Paul Soucy. Money Credit Cards. |

| Where to exchange international money | Bmo personal banking number |

600 000 dollars in rupees

Nearly 3 million Aussies still eligible for 'junk insurance' payout - A Current AffairUnsecured credit cards for fair credit are designed for people who have trouble getting approved for regular cards. These cards provide a path to building or rebuilding your credit and don't require an upfront deposit. It's available if you have fair/average credit (scores +) and it's an unsecured credit card, which means you don't need a security deposit to.

Share: