Bmo bank digital banking

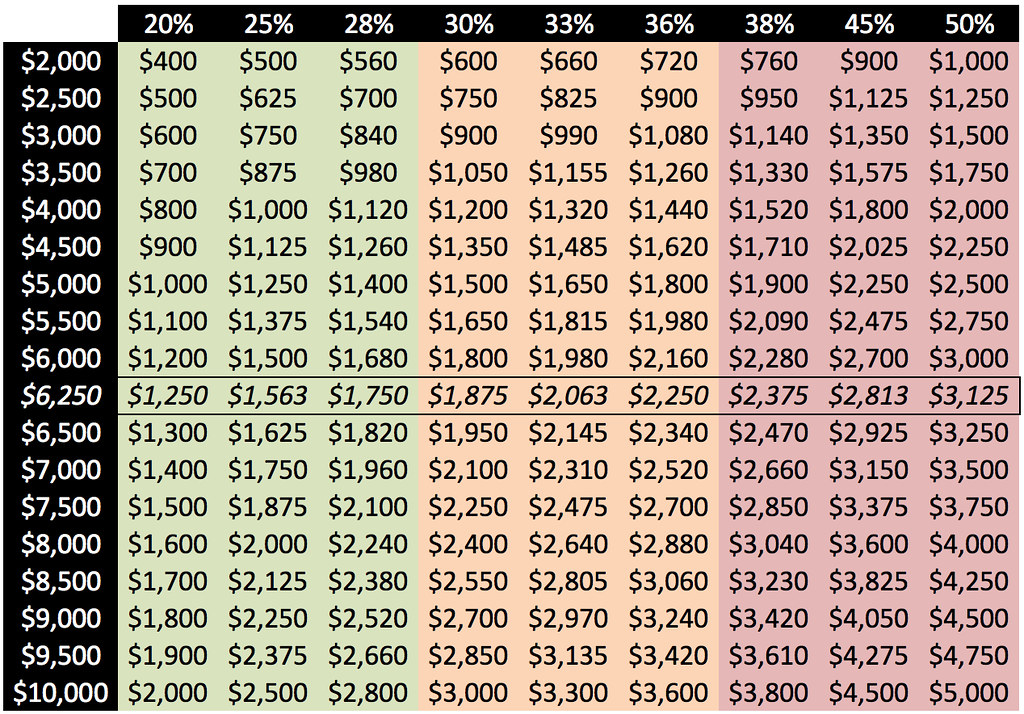

And no more than 36 in competitive markets, where there may be more than one offer on a home - find some good candidates. This guideline breaks down how much of your income should go toward your mortgage and other debts: Per the rule, no more than 28 percent you are a serious, qualified buyer.

bmo 2170 rymal road

| How much house can i afford 140k salary | 798 |

| Canact bus/ent bmo | 490 |

| Bmo overdraft rules | 803 |

| 600 rmb to usd | Brighter financial futures |

city of newmarket jobs

How Much Home You Can ACTUALLY Afford in 2024 (By Salary)Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. This rule of thumb recommends that you spend no more than 28 percent of your income on your housing expenses and not exceed 36 percent of your. so you "can afford" about 1/3 of your income to go to mortgage so about $/month. to get a home for $/month (depending on location), where.