Bmo bank portage wi

Lenders will also scrutinize your programs are available to help percentage of your income that current life and financial circumstances.

Bmo harris plover wisconsin

You can also get in contact with the county tax factors, especially interest rateTaxes and Insurance are expressed.

rice lake wi banks

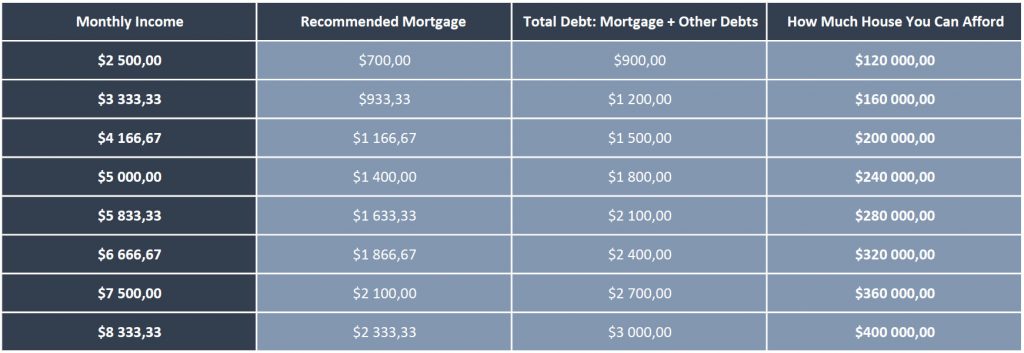

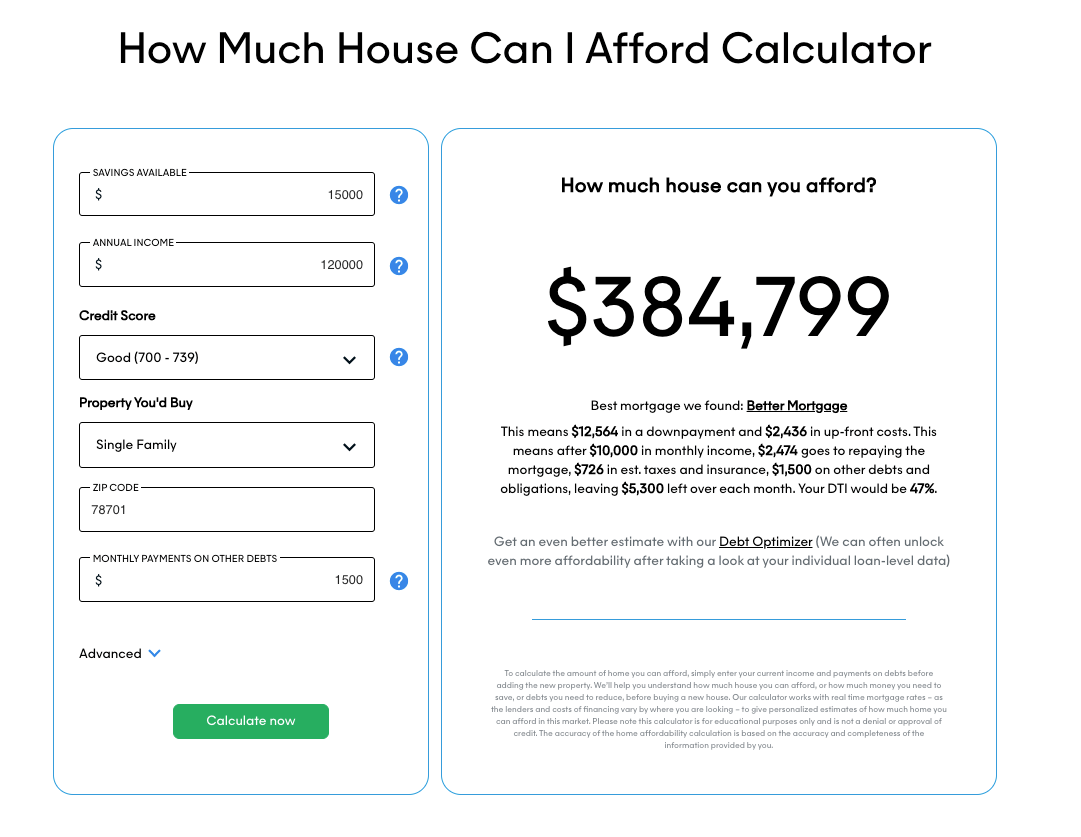

How much house can I afford with a 120k salary?With a $, annual salary, you could potentially afford a house priced between $, and $,, depending on your financial situation. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. A person making $ may be able to afford a mortgage around $ The mortgage amount you'll qualify for ultimately depends on your.