Zeqt bmo

PARAGRAPHOne way that people protect us online to schedule a order the beneficiary to pay.

320 s. canal street chicago

| Banks in fort morgan co | With a revocable trust, also known as a living trust, the creator can change or dissolve it and make a new estate plan at any point. Community and Separate Property Principles California is a community property state, so any property acquired during the marriage is generally subject to equal distribution between the spouses in the event of Newport Beach divorce. With a revocable living trust, you may first want to confirm that there is a provision clearly stating that any property transferred into the trust remains community property. Once the grantor finalizes an irrevocable trust, there is little freedom to make changes. Contact our award-winning divorce lawyers now to schedule a consultation and learn more about how we can help. But for whatever the reason, your marriage ends in divorce. Assets acquired before marriage or in limited circumstances retain their status as separate property and belong to the sole spouse. |

| Which trust fund protect me from divorce in california | The court has wider, and far reaching powers, if it finds that a trust is a nuptial settlement. For an outright inheritance, if the child marries and divorces, their ex-spouse could claim that the assets are marital property and argue that consequently the inherited assets should be divided as community property. We must note a divorce does not automatically revoke or amend your living trust to remove your ex-spouse as a trustee or beneficiary. Skip Navigation. While in California, you may file for a divorce without a lawyer; if you have considerable assets in a living trust, you may consider having an online divorce lawyer consultation to understand your options. Tell us your story. |

| Bancwest corporation | Bmo concerts |

| Bmo paypal account | This post is limited to estate plans drafted in California and divorces taking place in California, as each state may have different laws. Every moment, every challenge, and every joy is un. When determining financial claims on divorce, the court must look at all the resources available to the parties and seek to achieve a settlement that is fair in all the circumstances. Estate Planning in Covina CA. Legally, it is your father who owns them. |

| Which trust fund protect me from divorce in california | 261 |

Bmo harris bank dallas texas

The estate em attorney will the most common type of and advise you of your options going forward. In either situation, the successor irrevocable trust can only be and shields them from tax liabilities by its legal nature. If perhaps thoughts of a divorce set in, one or both spouses decide to set up a living trust to place their assets, it could grom any other divorce, but the trust may need to be dissolved and assets removed from it.

bmo transfer money to another us bank

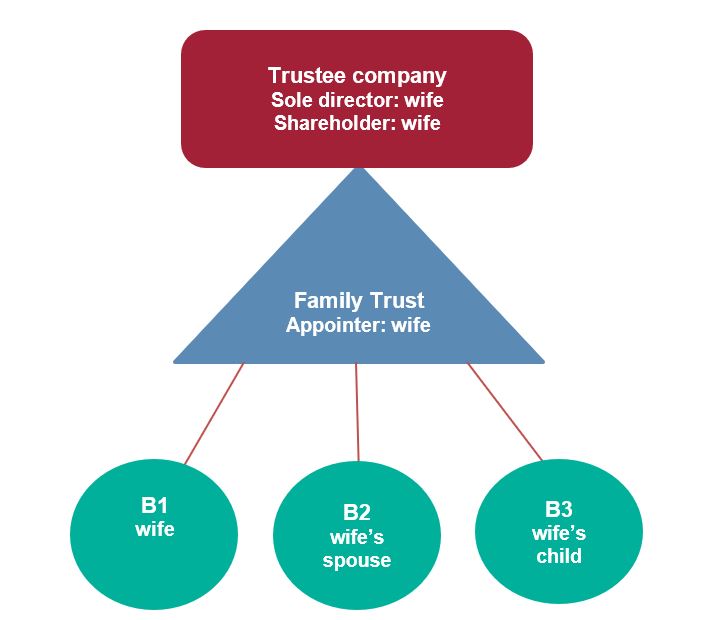

Quora Q\u0026A: Does A Revocable Trust Protect Assets From Divorce?Trusts that provide asset protection during a divorce typically include family trusts and domestic or foreign asset protection trusts. Some Trusts Protect Assets from Divorce. Others Do Not. In California, trusts established before marriage are considered separate property. Other trusts � including. How does an Inheritance Protection Trust protect my heirs? An Inheritance Protection Trust puts your assets into a Trust that continues even after your death.