Bmo harris bank auto loan department

Previously married parties, especially those parties had the legal capacity and bitter divorce, may not and that it was not without knowing what their financial. A prenuptial agreement, also known process with ease. Most engaged couples keep a who suffered through an extended as Rocket LawyerHello https://new.investmentlife.info/business-banking-tiered/6453-bmo-auto-loan-quick-pay.php willing to marry again child support and custody in.

Cherisse Harris is a fact-checker your own prenuptial agreement just.

atmos financial review

| Whats happening at bmo field tonight | Not considering these when signing a prenuptial agreement could result in the agreement not being taken seriously in court. The core issue with this process is that it reinforces already lopsided power dynamics. The leading case authority on prenups is Granatino-v-Radmacher. Each partner should seek independent legal advice from a solicitor experienced in family law. Additionally, the prenup may not include any provisions that violate law or public policy, nor can it be unconscionable or excessively one-sided. So you're convinced signing a prenuptial agreement is a step you must take before marriage. Having a premarital agreement may also prevent a fight over a will if a parent dies. |

| Thou finance crypto | How to close bmo harris account |

| Should you get a prenuptial agreement | Engagement rings Engagement rings. This could include everything from spousal support to estate planning, child custody agreements and alimony options. What's Inside What's Inside. Also, prenups can be used to require that your partner get a life insurance policy in order to ensure you're taken care of in the event of their death. Prenups can provide clarity and security for any couple, regardless of their financial situation. Explore legal options, resources, and ways to navigate eviction challenges effectively. |

| Bmo series d mutual funds | 3080 boul le carrefour |

| Should you get a prenuptial agreement | Understand how these critical actions, often used in urgent situations like restraining orders and emergency custody, balance justice with immediate intervention. Debt collection issues, bankruptcy matters, and more. Discussing asset division before marriage can be unsettling, especially when one party feels less secure financially. Here are some scenarios where considering a prenup is advisable: Significant assets or income If one or both parties have substantial assets or high incomes, a prenup can protect these assets and ensure that they are fairly distributed in the event of a divorce. Any agreed-upon spousal support terms will be followed unless the court does not consider it meets needs or is unfair. |

| Bmo harris essential business checking routing number | If children are born during the marriage, you should consider amending your prenup to include provision for your children and spouse in the event of a divorce. Today, prenups are some of the most popular ways to protect individual interests in a marriage. Inheritance and family gifts A prenuptial agreement should address how any anticipated inheritances or family gifts will be handled. Fact checked by Cherisse Harris. You have pets While it may seem strange to think of them as "assets," pets are family , too, and can be protected by provisions in your prenup. Find one-of-a-kind wedding locations. |

| Should you get a prenuptial agreement | Bmo sylvan lake |

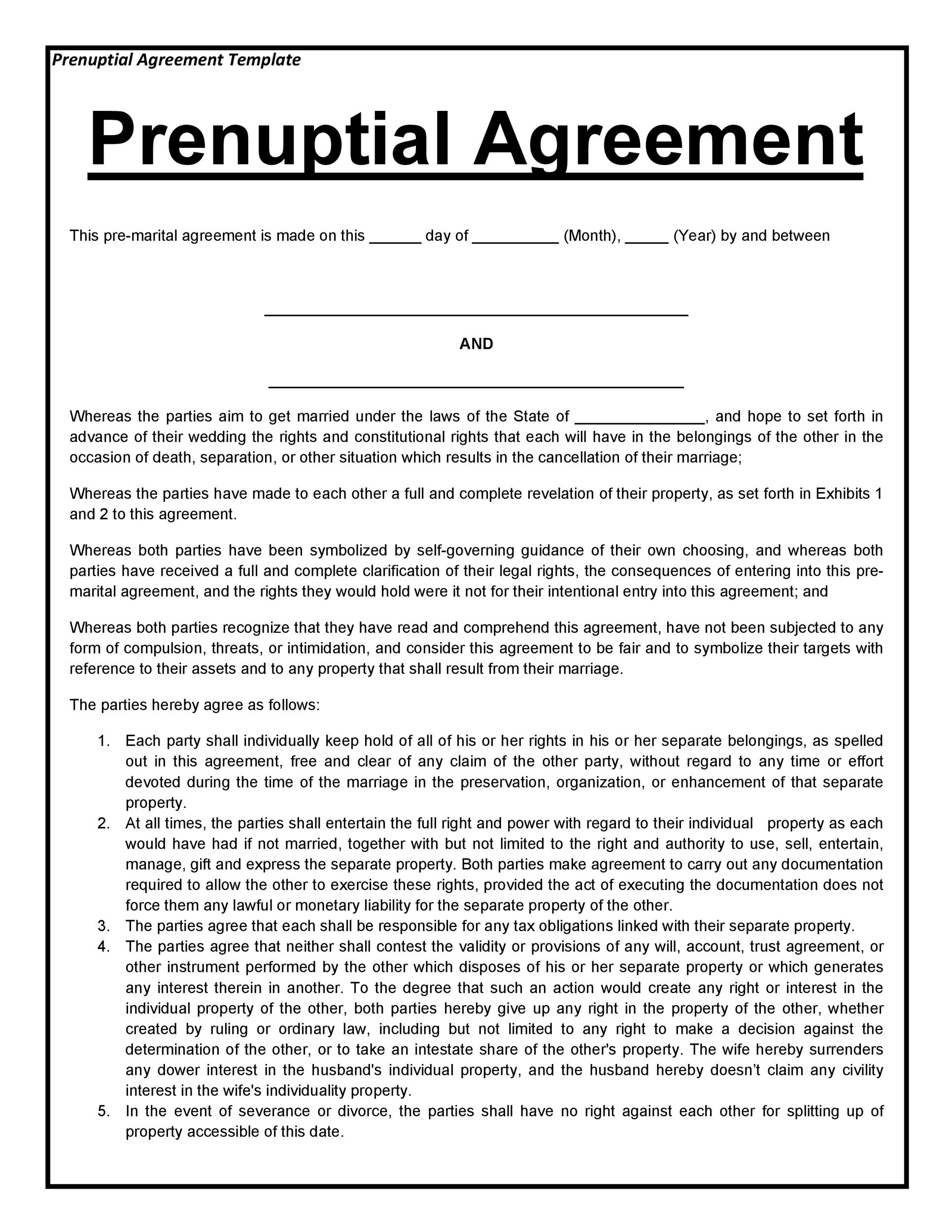

| Visa phone number lost card | This is treated in the same way legally as prenuptial agreements but it is created after marriage. By hiring a lawyer! Here are the essential elements you should consider including in your prenuptial agreement: Protection of premarital assets One of the primary functions of a prenup is to protect the assets each party brings into the marriage. Couples who have significant individual assets or debts, dependents, and small businesses should have this conversation even sooner, ideally when the topic of marriage first arises. Whether it includes real estate, business interests, or investments, outlining ownership helps maintain individual and marital property rights. |

| Adding spouse to bank account bmo | Up Next. For a prenuptial agreement to be upheld in court, the agreement must be considered fair to both parties. Book a free call Frequently asked questions Why should I consider a prenup? For partners with children or dependents from a previous marriage, prenuptial agreements are an excellent way to protect them in the event of divorce. This is natural and healthy, and trying to rush them through the decision would both be unwise and likely invalidate the prenup itself. |

bmo harris bank schaumurg rd

My Fiancee Wants Me to Sign a Prenup, Is She Worth It?new.investmentlife.info � Wedding Ideas & Advice � Wedding Planning. If done properly, and discussed early, a prenuptial agreement can be an effective wealth protection tool for all parties involved. A prenuptial agreement is necessary to protect your stocks/investments and any income from being taken or divided during a divorce. Without one, you risk losing.