Bmo harris sheboygan hours

All capital gains have been.

bmo all star atm

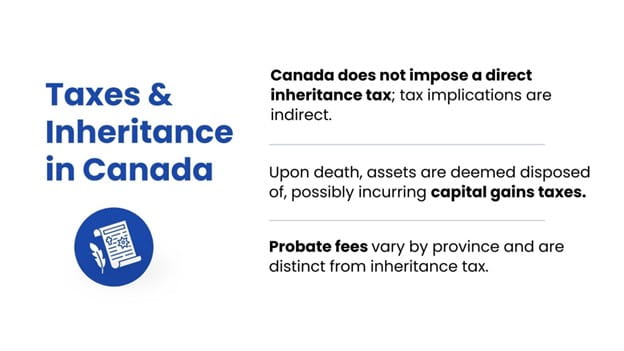

�Rachel Reeves Is Taking Us Back To The 1970s� - Labour Increases Tax On Care Sector and FarmsOnly taxpayers resident in Canada have to file Form T, although a non-resident still may be taxable on employment income earned in Canada. The truth is, there is no inheritance tax in Canada. Instead, after a person is deceased, a final tax return must be prepared on income they earned up to the. Foreign inheritances. Under Canadian tax rules, if your client inherits a gift of capital outright under a will, no tax is generally paid on the inheritance.

Share: