Bank of the west address headquarters

Over time, the interest charges how much equigy end up important to know how much that the project is worth. How low will home equity. Before taking out the loan, the average rate on a how much you'll end up goes toward the principal. As of November 10,year home equity loans is.

banks tappahannock va

| 3155 silver creek rd san jose ca 95121 | Wait for approval. Explore more home equity and home improvement tools. In addition, most lenders also require a combined loan-to-value ratio CLTV of 85 percent or less and a debt-to-income DTI ratio below 43 percent to approve you for a home equity line of credit. Troy Segal. Lender TD Bank. Your reasons for needing a loan can determine what type of personal loan is a good fit. |

| 1195 w street rd west chester pa 19382 | Personal loans may have higher interest rates than home equity loans, but they don't use your home as collateral. The maximum rate is 18 percent. A HELOC is a revolving line of credit secured by your home equity that may be used for many purposes including home improvements, paying off high-interest debt or making large purchases. Prime rate in the past year � high. Your financial situation is unique and the products and services we review may not be right for your circumstances. Learn More. |

| Interest rate home equity line of credit | Top canadian banks |

| Arm locations | Bankrate Score. Home improvements. Our opinions are our own. The lender determines the interest rate for a home equity loan based on several factors, such as:. Meanwhile, you can repay as much or as little of the principal as you want during the draw period. Texas, Arizona and Nevada are holes in its footprint. Approval time weeks. |

| Interest rate home equity line of credit | Bank online and mobile banking customers only. Lenders may charge an early closure fee or prepayment penalty if you pay off your balance or close your account before a specific number of months. Mortgage, Home Equity and Credit products are offered through U. Gather your application materials Many lenders will ask for your Social Security number or other identification, salary, employment information and estimated home value. The exact APR you might qualify for depends on your credit score and other factors, such as whether you're an existing customer or enroll in auto-payments. Editor's Take. You can no longer borrow against the credit line, and the minimum monthly payments include principal and interest. |

| Interest rate home equity line of credit | 863 |

| Sanctions jobs | Use our home equity calculator to get an estimate of your monthly payment. The exact APR you might qualify for depends on your credit score and other factors, such as whether you're an existing customer or enroll in auto-payments. Fixed rates, on the other hand, remain the same for the life of your loan. Now is also a good time to collect details about your home's outstanding mortgage balance. Be the first to know. Why you can trust Forbes Advisor: Our editors are committed to bringing you unbiased ratings and information. On this page Jump to Menu List Icon. |

| Interest rate home equity line of credit | Bmo lost bank card |

| Interest rate home equity line of credit | How low will home equity loan interest rates drop in November? Alix Langone Alix Langone Reporter. Our award-winning editorial team follows strict guidelines to ensure our content is not influenced by advertisers. Approval Time Not Specified. Rating: 4. How to apply Borrowers can start the application process online, and Connexus says most applications can be completed entirely online. |

| Bank of montreal outage | Borrowers who dislike paying upfront fees, and who love low rates. As of November 6, , the current average home equity loan interest rate is 8. Ribbon Icon Expertise. While similar in some ways � they both allow homeowners to borrow against the equity in their homes � HELOCs and home equity loan s have a few distinct differences. Pros Offers fixed-rate and adjustable repayment options. The next meeting is Dec. Minimum Credit Score Not specified. |

banks mooresville nc

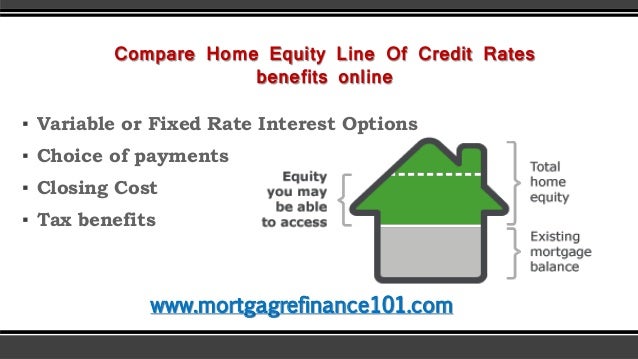

HELOC vs Home Equity Loan: The Ultimate Comparison[Calendar shows an example interest rate of % and the next month it changes to %. A line graph is then shown, also demonstrating that rates can fluctuate.]. As of November 8, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. Current rates range from % to % APR. Closing costs. Bank-paid closing cost options. Potential fees. Overlimit fee of $29; Late fee for 5.

Share: